Future of Taiwan’s Economic Competitiveness

In 2019, the Asia Program of the Carnegie Endowment for International Peace, in collaboration with the Taiwan WTO & RTA Center of the Chung-Hua Institution for Economic Research (CIER), began to jointly convene a series of roundtables with U.S. and Taiwan stakeholders.

The initiative has two major goals: first, to examine challenges to Taiwan’s future competitiveness and comparative advantage amid technological change, global economic disruption, and rapidly evolving political risk; and second, to explore where and how fresh partnerships between U.S. and Taiwan players can help to bolster Taiwan’s economic future.

The initiative is focused in several areas:

- assuring Taiwan’s technological advantage amid significant challenges to its innovation ecosystem;

- disruptive energy futures as Taiwan grapples with the trilemma of security, affordability, and sustainability;

- improving Taiwan’s investment climate to attract not just more but also highest-quality foreign investment; and

- potential supply chain opportunities for Taiwan as technological, economic, and geopolitical changes lead governments and multinational firms to rethink vulnerabilities, resilience, and options in emerging industries.

This paper on Taiwan’s supply chain opportunities in two evolving industries—life sciences and safer software—is the third in a series. It draws, in part, on the insights of more than two dozen expert participants in two virtual transpacific workshops convened in 2021 by Carnegie and CIER. The authors of this study, Evan A. Feigenbaum and Michael R. Nelson, have drawn on perspectives from those contributors, as well as other leading policy and industry analysts on both sides of the Pacific. We are particularly grateful to our co-convenor, Roy C. Lee of CIER, for helping to pull together these workshops and for facilitating intensive conversations.

We particularly acknowledge the input, comments, and critiques received from Joy Chan, Scott Charney, Eugene Chiu, Cynthia Chyn, Leslie Daigle, Dan Hanfling, Katie Moussoris, Kevin O’Connell, Gregory Shannon, Mary Shaw, Megan Stifel, and several industry and policy executives in both Taiwan and the United States.

A very special thank you to Jacob Feldgoise, Hana Anderson, and Alex Taylor of the Carnegie Endowment for International Peace—for comments on the paper, invaluable background research, and essential support of the project.

Executive Summary

To some, the acute supply chain crisis that has followed in the wake of the coronavirus pandemic is a sign of poor planning, lack of resilience and surge capacity, and industry rigidity. Inflation is also having a major impact and will inevitably lead to some supply chain reconfiguration. But structural shifts matter too, including rising costs in mainland China—the world’s manufacturing’s powerhouse—and the overconcentration of freight in just ten companies that control 85 percent of global container capacity.

Globalization has bequeathed a system that seemed efficient until it was tested by the multidimensional crises of the last two years. In industry after industry, C-suites are planning for a world of disruption. At a minimum, companies aim to build resilience and redundancy into their supply chains.

But there is another factor—political risk—that is complicating planning, especially in technology-intensive industries. Specifically, the emergence of multidimensional strategic competition between Beijing and Washington has interrupted the flow of goods, capital, people, technology, and data. And these geopolitical disruptions look set to become a long-term structural trend.

This is a sea change that will invariably bleed into many industries and rejigger supply chains. But amid the disruption, some economies will have fresh opportunities to attract investment, build out new industries, and diversify their growth drivers. Taiwan is one such economy that may stand to benefit from the supply chain rethink. This paper explores some ways that it could do so.

But to seize opportunities in this dynamic environment, Taiwan needs policy changes and technology investments to better position its ecosystem of government, business, academia, research institutions, and labor to attract new supply chain opportunities, especially for the Fourth Industrial Revolution and the emerging economy of the twenty-first century.

Two prior Carnegie Endowment studies of Taiwan’s economic competitiveness included specific recommendations that could comprise the foundation of an ecosystem that serves the public interest by bolstering Taiwan’s profile and role in more and more global supply chains. Most notably, these were Carnegie’s recommendations to position Taiwan’s economy as a trusted hub, trusted vendor, trusted tester, and trusted conduit for technology-intensive R&D and production.

Taiwan’s public interest would benefit if such opportunities became a counterpoint to mainland China’s scale advantages. But Taiwan faces intense competition from other economies in Asia and Europe that also seek to capitalize on supply chain shifts, reaping the harvest from their investments while carving out specialized niches amid rising suspicion of mainland China-origin technology products and services.

This study aims to help to refine competitive choices for Taiwan while highlighting unique comparative advantages that would make it an especially attractive place for new global investments. The paper digs deeply into two opportunities for Taiwan.

The first involves dynamic changes in one of the high-tech industries that Taipei has made into a strategic priority—the life sciences, including biotechnology and precision medicine. Despite twenty years of concerted effort and some signal successes, especially with drug development and diagnostics, Taiwan has not captured a role or market share analogous to its multidecade build-out in semiconductors.

For Taiwan, trust will be the crucial variable and competitive advantage. Taiwan could, for example, leverage its advantages with high-quality medical data to become a locus for clinical trials, while also leveraging other advantages for global supply chains in the drug discovery, advanced diagnostics, and personalized medicine markets.

But to do so, it will need to make policy and regulatory changes and make some new strategic investments.

The second chapter turns to whether Taiwan’s economy could be positioned as a leader in testing, validating, and deploying software, which would give Taiwan-based firms a larger role in the information technology services business where mainland China, India, and others have a larger profile. Elements of Taiwan’s ecosystem could potentially be positioned to use software engineering to ensure that business software and services produced by local companies and their international partners are more tested and more trusted than competing products on the market.

Both chapters emphasize that international partnerships, particularly with U.S. players, could naturally complement a revitalized and broadened innovation strategy for Taiwan. The paper:

- explores pressing obstacles that presently stand in the way of Taiwan’s supply chain opportunities in these two key sectors;

- proposes specific ideas to government, industry, and capital markets players to help alleviate and overcome some of these obstacles; and

- recommends forward-looking partnerships between Taiwan and especially U.S. players to facilitate these ideas.

Introduction

Supply chain bottlenecks have become a headline story in 2021, as shipping containers pile up on docks from China to California and as logistics managers strain to fill orders.

To some observers, the acute supply chain crisis that has followed in the wake of the coronavirus pandemic is a sign of poor planning, lack of resilience and surge capacity, and industry rigidity.1 Inflation, too, is having a major impact and will inevitably lead to some supply chain reconfiguration. Higher interest rates mean that the costs of higher inventory levels become material very quickly, pressuring companies to go back to older, leaner models.

But structural shifts matter too, including rising costs in mainland China2—the world’s manufacturing powerhouse—and the overconcentration of freight in just ten companies that control 85 percent of global container capacity.3

Globalization has bequeathed a system that seemed efficient until it was tested by the multidimensional crises of the last two years. Corporate and market thinking is unlikely to remain the same. In industry after industry, C-suites are planning for a world of disruption. At a minimum, companies aim to build resilience and redundancy into their supply chains.

But there is another factor—political risk—that is complicating planning, especially in technology-intensive industries. That risk has put a brake on easy, straightforward solutions, like building extra capacity in China. Specifically, the emergence of multidimensional strategic competition between Beijing and Washington has interrupted the flow of goods, capital, people, technology, and data. And these geopolitical disruptions look set to become a long-term structural trend.

This is a sea change that will invariably bleed into many industries and rejigger supply chains. But amid the disruption, some economies will have fresh opportunities to attract investment, build out new industries, and diversify their growth drivers.

Taiwan is one such economy that may stand to benefit from the supply chain rethink. This paper explores some ways that it could do so.

Resurgent Technonationalism

One consequence of growing U.S.-China tensions will be the realignment of at least some global supply chains. Indeed, both the U.S. and Chinese governments—and the Japanese as well as various European governments, for that matter—are leveraging administrative and regulatory tools to limit, and in some case attenuate, commercial flows. This includes a more robust use of export controls, more expansive investment screening mechanisms, passage of national security legislation, and the imposition of sanctions.

But as security competition bleeds back into many areas of commercial exchange, technology flows are particularly vulnerable to this “securitization” of economic policy. That is because so many emerging and foundational technologies are dual-use and have multiple applications.

From Washington to Beijing to Brussels, technonationalism now threatens to fracture globalization. Decisionmakers and regulators are increasingly scrutinizing the strategic and geopolitical implications of technology research, development, production, and cross-border flows, ultimately privileging security concerns over commercial benefits.

For decades, policymakers everywhere presumed that economic integration could lift all boats while mitigating security competition among nations. But as the U.S.-China security competition intensifies, security is now bleeding back into economics. Thus, many countries now aim to indigenize key technologies (or at least ensure access to various suppliers), reduce external dependence, and ensure a privileged role for their own preferred engineering standards.

Technonationalists take an intrinsically strategic view of industry and technology. They view it as fundamental to both security and competitiveness and take it on faith that economic policies must have strategic underpinnings. And this extends to many supply chains because, while they accept that technology must be diffused, they would prefer that it not be diffused to strategic rivals.

In many cases, therefore, they seek to influence supply chain choices for key technologies and commercial goods. This competition is not only playing out in semiconductor and chipset manufacturing—an industry that is especially important to Taiwan—but even in pharmaceuticals.

Just take Taiwan’s champion chipmaker, Taiwan Semiconductor Manufacturing Company (TSMC). It does a profitable business in mainland China, producing chips designed by mainland customers for an array of industries, from autos and consumer electronics to smartphones. But the company is under growing political pressure from Washington not just to invest directly in the United States but to curtail elements of its business across the Taiwan Strait.4

Nor is this pressure unique to TSMC. In September 2021, the U.S. Commerce Department hauled in global chipmakers for a White House–hosted Summit on Semiconductor and Supply Chain Resilience, where the U.S. administration gave leading global firms, including TSMC and South Korea’s Samsung, forty-five days to comply with a voluntary request to turn over internal information on inventories, orders, and sales.5

This pressure springs, in part, from the growing centrality of strategic and security factors. In many industries, the United States and other advanced industrial economies no longer fully trust the supply of critical high-technology products and services from the People’s Republic of China (PRC).

The coronavirus pandemic has only exacerbated this gathering mistrust. For example, for the pharmaceutical and biomedical industries, a bipartisan group of United States senators has called for steps to reduce U.S. dependence on products, medicines, and ingredients that originate in the PRC.6

At a minimum, this growing mistrust means that the U.S. government and many U.S.-based firms will seek to diversify their supply chains over the next three to five years to reduce dependence on Chinese supply.

The first line of this effort will be to establish redundancy and assure greater resiliency. But in at least some industries, the U.S. government may go further still, mandating by law, regulation, or administrative fiat that supply chains can no longer include products and services that originate in the PRC.

This will shape the behavior and choices of American firms. But it will have wider resonance too, as other governments, especially in Western Europe and Japan, consider whether to follow suit.

Taiwan’s Opportunity

In this dynamic environment, policy changes and technology investments could better position Taiwan’s ecosystem of government, business, academia, research institutions, and labor to attract new supply chain opportunities, especially for the Fourth Industrial Revolution and the emerging economy of the twenty-first century.

Two prior Carnegie Endowment studies of Taiwan’s economic competitiveness included specific recommendations that could comprise the foundation of an ecosystem that serves the public interest by bolstering Taiwan’s profile and role in more and more global supply chains. Most notably, these were Carnegie’s recommendations to position Taiwan’s economy as a trusted hub, trusted vendor, trusted tester, and trusted conduit for technology-intensive research and development (R&D) and production.7

Taiwan’s public interest would benefit if such opportunities became a counterpoint to mainland China’s scale advantages. But Taiwan will face especially intense competition from other economies in Asia and Europe that will also seek to capitalize on supply chain shifts, reaping the harvest from their investments while carving out specialized niches amid rising suspicion of PRC-origin technology products and services. Many players, especially in Asia, will be jockeying and competing for supply-chain-related investments in people, plants, and assets. Put bluntly, the realignment of supply chains will create economic opportunities for Taiwan, yet such a role in technology-based supply chains is by no means assured. This study aims to help to refine competitive choices while highlighting unique comparative advantages that would make Taiwan an especially attractive place for new global investments.

Thinking Creatively: Disrupting Established Industries

It is important that Taiwan think creatively and expansively about its opportunities. After all, while much of the debate about Taiwan’s supply chain opportunities focuses on semiconductors, the fact is, Taiwan could also disrupt and upgrade even established lower-technology supply chains between, say, the United States and Southeast Asia. That region is the major focus of Taiwan’s New Southbound Policy and is an area of still-untapped commercial and strategic opportunity for Taiwan’s economy.

Southeast Asian exports to the United States encompass an array of traditional industries, like food and agriculture, that are low-tech in nature but whose supply chains will be transformed by high-tech solutions in the coming years. So, Taiwan-based players could potentially leverage existing technology advantages and new tech-related investments in the Internet of Things (IoT) and blockchain to disrupt and upgrade these Southeast Asian supply networks.

Skepticism of the “made in China” label is reorienting even the food and agriculture industry. Although the United States imported a staggering $4.6 billion in food from China in 2017,8 it increasingly seeks to diversify its supply chain, not least by bolstering the role of the very Southeast Asian countries with which Taiwan also seeks to build closer ties.

Consumer-oriented products dominate U.S. agricultural imports and have grown faster than total agricultural product imports. Five Southeast Asian countries where Taiwan has strong commercial ties—Indonesia, the Philippines, Singapore, Thailand, and Vietnam—have become leading exporters to the United States, mostly for commodities, like frozen seafood, where technology-enabled tracking and traceability in multiparty supply networks could ensure safety, security, and reliability.

So, in a creative and expansive view of supply chains, Taiwan’s ecosystem could deploy technologies, such as IoT and blockchain, to insert itself into, disrupt, and upgrade these networks. This is consistent with the idea of Taiwan as a trusted conduit—in this case, one that helps to guarantee food safety and security by deploying technology for end-to-end traceability, temperature sensing, and enhanced supply chain performance.

Broadening Taiwan’s Opportunities in the Life Sciences

But this paper digs deeply into two other opportunities, especially.

The first of these involves dynamic changes in one of the high-tech industries that Taipei has made into a strategic priority—the life sciences, including biotechnology and precision medicine. Despite twenty years of concerted effort and some signal successes, especially with drug development and diagnostics, Taiwan has not captured a role or market share analogous to its multidecade build-out in semiconductors. Nor has it established a true biotech analogue to Hsinchu, its world-class hub for semiconductors, computers, and other hardware industries. Beijing, by contrast, has established its own biotech hubs in cities like Suzhou and Zhangjiang. Taiwan should try to leverage the Hsinchu model, drawing on some lessons of its successful past experiences with hardware.

For Taiwan, trust will be the crucial variable and competitive advantage. In biotech and pharmaceuticals, China-origin (and to a lesser extent, India-origin) supply chain dependence is now squarely in the crosshairs of the U.S. government, Congress, and regulators. And even without this heightened scrutiny, the pandemic has highlighted the importance of establishing more diverse and resilient supply chains. So, Taiwan-based players have some fresh opportunities in the life sciences sector to capture new investments and next-generation R&D as developers, manufacturers, and governments reconsider their options and look for trusted partners and suppliers.

While some firms, including Merck and AstraZeneca, have made new investments, Taiwan has not sufficiently increased its share of the emerging global biomedicine market. Building on another of Carnegie’s recommendations from earlier studies to foster new advantages as a trusted tester for Asia and the world,9 this chapter on life sciences opportunities explores how Taiwan could leverage its advantages with data to become a locus for clinical trials, while also leveraging other advantages for global supply chains in the drug discovery, advanced diagnostics, and personalized medicine markets.

Taiwan boasts high-quality medical data from the National Health Insurance database, strong intellectual property (IP) protections, improved patent safeguards, and a deep well of scientific and biomedical talent. But it needs to make policy and regulatory changes, expand the pathways for biotech IPOs, and make some new strategic investments.

Investing in a Competitive Advantage for Software and Services

The next chapter turns to the second opportunity: whether Taiwan’s economy has an opportunity to be a leader in testing, validating, and deploying software, which would give Taiwan-based firms a larger role in the information technology (IT) services business where China, India, and others have a larger profile.

Software has become the last path to differentiation in most competitive industries. But trust in the integrity of software and services is declining because of mounting concerns over inadvertent vulnerabilities in the software supply chain, incorrect algorithms, and intentional backdoors installed by state and corporate actors. One example is the alleged Russian manipulation of Kaspersky Lab antivirus software,10 which is precisely the sort of crucial issue that has been raised around software supply risks.

Malware or even surveillance tools can be embedded into apps that millions of people use every day. And while there has been much discussion about whether Beijing is working with Chinese hardware companies such as Huawei to enable surveillance of its customers, the threat posed by “backdoors” in software, apps, and cloud services should be getting at least as much attention.

The quality and security of the open-source components that find their way into so many commercial products have become essential issues in the high-tech services supply chain. In addition to security, there is a growing realization that software modules from third parties sometimes do not function as advertised. This could well become an even greater concern when machine learning algorithms are used to develop mission-critical tools. Using algorithms that are accountable and explainable is a desired goal but will not be easy to achieve.

Elements of Taiwan’s ecosystem could potentially be positioned to use software engineering to ensure that business software and services produced by local companies and their international partners are more tested and more trusted than competing products on the market.

This chapter examines whether and how it might be possible for Taiwan to make software quality a national goal in the public interest and then potentially partner with leading business software and services companies that share this goal. Hunting down defective code and putting more pressure on IT companies to adopt tools for improving software quality could have an impact worldwide and position Taiwan-based firms to be bigger players in the software and services industry.

Above all, both chapters emphasize that international partnerships, particularly with U.S. players, could naturally complement a revitalized and broadened innovation strategy for Taiwan. The purpose of this paper, then, is threefold:

- to identify the most pressing obstacles that presently stand in the way of Taiwan’s supply chain opportunities in these two sectors;

- to offer specific ideas to government, industry, and capital markets players to help alleviate and overcome some of these obstacles; and

- to explore how forward-looking partnerships between Taiwan and especially U.S. players could potentially contribute to those ideas.

Broadening Taiwan’s Opportunities in the Life Sciences

Rapid advances in the life sciences– and healthcare-related industries are changing the way we live, treat illnesses, and age. And capital has followed these trends, pouring money into an array of life sciences–related industries, from biopharmaceuticals to revolutionary diagnostics and precision medicine.

In 2020, despite the economic drag of the coronavirus pandemic on businesses and balance sheets, biotechnology had a staggeringly good year, with all regions of the world nearly tripling initial public offerings (IPOs) in biotech as COVID-19 vaccines and disruptive therapies spurred investment in an exciting future of discovery and treatment. The promise of mRNA technology is just one example of how the marriage of science and industry are opening new doors to the treatment of diseases and conditions.

In 2020, forty-four biotech IPOs in the Asia-Pacific region alone ensured a steady influx of multinational capital. Globally, more than seventy-three life sciences firms raised an astonishing $22 billion through IPOs in 2020. By September 2020, the global biotech market had reached $414 billion, with 58.3 percent of market value coming from U.S. companies, 8.2 percent from mainland China and Hong Kong, and 2.4 percent from Taiwan (see figure 1).11

Taiwan has been an innovation pioneer, but disproportionately in hardware industries like semiconductors. Still, it has long sought to tap and ride cutting-edge innovation trends of all kinds, and biotechnology is no exception. In the 1980s, Taiwan had only a modest biotechnology industry, and it certainly lacked global ambitions and reach. But to build the sector, much as it did with semiconductors, Taiwan has relied on the same three-legged model that delivered considerable technological successes over four decades: first, government competition policy to promote industrial development; second, internationalization, particularly through the connections fostered by what AnnaLee Saxenian has called “brain circulation” of mostly U.S.-educated technologists who returned to Taiwan to found entrepreneurial businesses;12 and third, an effort not just to combine quality with cost advantage but to innovate independently.

The best example of this model is, of course, Taiwan Semiconductor Manufacturing Company, founded in 1987 by a returnee from Texas Instruments, Morris Chang, with support from a leading government-backed research institution, the Industrial Technology Research Institute (ITRI). Today, TSMC dominates its sector internationally.

In biotech, entrepreneurs like Johnsee Lee have, in some sense, played analogous roles—in Lee’s case, receiving an American PhD from the Illinois Institute of Technology, returning to Taiwan in the 1990s, heading up ITRI, and founding two institutions to promote the biotech sector with the backing of government competition planners: ITRI’s own Biomedical Technology and Device Research Laboratories, and the government-financed Development Center for Biotechnology (DCB). Similarly, many of Taiwan’s leading biotech firms have been founded by other internationally educated returnees, often with American PhDs.13

In a 2018 interview, Lee pointed to “public, stable funding of research” as the key to Taiwan’s life sciences success thus far. And there have been some important successes: In just thirty-five years, Taiwan has gone from having no biotechs on the TAIEX and Taiwan OTC stock exchanges to 124 listed firms with a combined market capitalization of more than $30 billion by 2020 (see figure 2).14 In 2019, the consultancy PwC estimated that biotech accounted for nearly 20 percent of the listed companies in Taiwan,15 although this pace has slowed somewhat in the past two to three years.

And yet, despite intense government interest, Taiwan has not achieved the full promise of its ambitions for the life sciences sector. One reason is that the global biotechnology industry is changing faster than are Taiwan’s modestly sized firms. But another is that government policies in related areas, such as tax and regulation, restrain risk-taking in Taiwan more generally. This has been a drag on local biotechs, despite the government’s effort to set up state-backed incubators, encourage start-ups, and adjust sector-relevant regulations.

The good news is that Taiwan has built a handful of globally competitive companies, with an emphasis on cancer and infectious disease drug discovery and treatments, as well as a growing emphasis on advanced diagnostics. The DCB, in particular, has encouraged a new generation of biotech innovators to dive into drug development and then license their achievements to local firms.16

More good news comes from the fact that some of the leading Taiwan players, like TaiGen Biotechnology, have attracted both multinational partners and global investors. Those partners are important because every successful Taiwan biotech has had to overcome the inherent limitations of Taiwan’s small domestic market of just 24 million people; international partnerships can certainly help to do this. Meanwhile, global capital injections can help to cushion against a relative lack of interest from risk-averse local private investors. In fact, one reason Taiwan’s government has had to play such an outsized role in financing the island’s biotech sector is because the pipeline of local private capital dedicated to the life sciences has been comparatively weak.

Three Opportunities

Over a longer time horizon, however, big changes are coming to all life sciences–related industries. And this should give Taiwan some fresh opportunities to diversify its innovation base and play a larger role in some life sciences–related supply chains.

For one thing, success in biotech would allow Taiwan to further internationalize its innovation base by staking a claim to a dynamic and rapidly evolving industry with global reach. Equally important, however, Taiwan has the potential to seize investment opportunities as technological, economic, and geopolitical changes reshape supply chains and investment choices among multinational players, not least in areas where Taiwan excels, such as digital technology on the hardware side and trusted, transparent, high-quality data on the software side.

Taiwan has three broad sets of fresh opportunities in this sector—some that spring from technological change, others from evolving patterns of multinational investment, and still others that derive from dynamic geopolitics and changing views of the People’s Republic of China.

Technology Opportunity

Taiwan’s technology opportunities flow from two parallel trends.

First, biotech, like mechanical engineering, is no longer a sector per se but a span of capability that bleeds into many industries, from food, to fibers, to new energy technologies such as biogas.17 Biotech capability also includes a growing suite of life sciences tools that are being applied in various ways to continue advances in DNA editing, synthesis, and sequencing.

The government’s various national high-technology plans, such as the so-called 5+2 Innovative Industries Plan, treat biotech as a standalone sector. But because biotech is no longer synonymous only with biomedical or biopharma, Taiwan could, if it makes some adjustments, aim instead to leverage biotech innovations across multiple industrial verticals.

A second technology-based trend is the accelerating digitalization of healthcare, which plays to Taiwan’s advantages with both engineered hardware, such as semiconductors, and the software powered by high-quality data—for example, on treatments and outcomes, epidemiology, and genomics. The coronavirus pandemic has expanded the application of digital healthcare on a global scale, and this should be good news for Taiwan to leverage its existing industries in new ways.

One example is the new diagnostic capabilities being developed out of semiconductor-based technologies, a core advantage for Taiwan with broad and diverse application to the life sciences. For instance, new diagnostic technologies related to cancer or genetic aberrations rely on semiconductors to help analyze nucleic acids and molecular breakdown.18

Improvements in semiconductor technology and deployment are also becoming vital to vast new horizons in digital and connected healthcare—for example by helping to harness data from connected devices.19 Digital mobile technologies are being integrated with imaging, AI, and diagnostics. So, semiconductors, artificial intelligence (AI), mobile, and microsystems technologies—some of which are long-standing advantages for Taiwan—are revolutionizing many aspects of the new medical diagnostics and digital healthcare.

But another example involves the creative deployment of high-quality data. One application could be the use of AI to dramatically raise the success rate of clinical trials,20 both by more effectively selecting participants and by improving the design of the trials themselves. And during the coronavirus pandemic, Taiwan demonstrated its ability to deploy data in holistic ways—for instance, by integrating its national healthcare and immigration databases for contact tracing.

To attract clinical trials, Taiwan could strive to leverage these data advantages by positioning itself as a trusted manager of sensitive, high-quality healthcare data as therapies currently in the pipeline are brought to market.

Investment Opportunity

This, in turn, points to fresh investment opportunities because multinational players in the biomedical and biopharma space are actively looking for new R&D hubs, especially in Asia, while rejiggering elements of their supply chains. Good policies around industry, regulation, data, and reimbursement will make a difference in distinguishing one potential hub from its competitors.

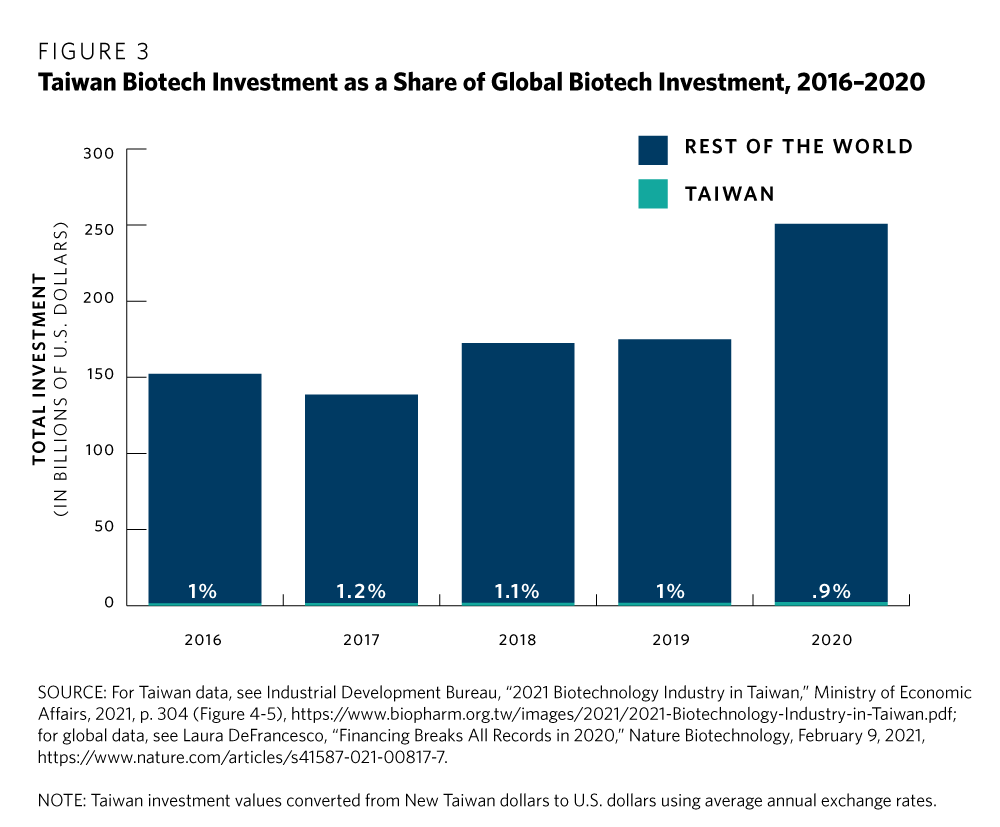

One of Taiwan’s challenges in biotech and the life sciences is that it faces stiff competition from other potential Asian hubs, such as Kobe, Seoul, Shanghai, Singapore, and Sydney. And some of these prospective hubs have advantages that Taiwan does not. For one, while Taiwan’s market share of the global biotech industry exceeded 2 percent in 2020, its share of global biotech investment has slackened, falling below 1 percent (see figure 3).

Japan, meanwhile, has become a leader in biotech patents and boasts strong university-based research that some others in Asia have struggled to match.21 Australia’s biotech sector is flush with federal government cash but also state-level support across Australia, including for precisely the kinds of therapeutics that Taiwan, too, aims to develop.22

What Taiwan needs, therefore, is not just aspirational national plans but targeted government policies that bolster both investment and especially competitiveness. Taiwan can certainly point to a track record of improved intellectual property protection for innovative medicines, including the establishment of a pharmaceutical patent linkage system that came into effect in August 2019 after many years of discussion and debate. Importantly, that system enabled new drug marketing approval holders “to list any patents covering their products and assert those patents against generic drug applicants in patent litigation actions.”23 But Taiwan still faces significant structural impediments to rewarding innovation. And pricing, reimbursement, and investment incentives remain problematic.

Just take reimbursement. Taiwan’s government often frets that U.S. companies will not sell cutting-edge drugs in Taiwan. It has, therefore, made some constructive reforms aimed at increasing market access. But while the speed of regulatory approvals has improved, reimbursement reforms have not kept pace. One 2020 study revealed significant reimbursement lags in Taiwan compared to some competitor nations.24 That, in turn, has decreased the interest of international pharmaceutical companies and global biotech companies in selling in Taiwan.25 And this has then had broader effects, including on Taiwan’s potential to become a hub for clinical trials.

Still, the pandemic has laid bare supply chain issues for biologics, small molecules, and active pharmaceutical ingredients (APIs). So, some countries and companies around the world are now rethinking their existing supply chains. This disruption opens the opportunity for new players, like Taiwan, to build out manufacturing and provide optionality.

Geopolitical Opportunity

Indeed, this very supply chain rethink also points to a big advantage in Taiwan’s favor: the geopolitical opportunity that flows from growing mistrust of mainland China-origin products and mistrust of the Chinese state’s hand in incentivizing, financing, and harnessing the innovations and data that flow from its rapidly growing biotech sector.26

On many metrics, Beijing has undertaken an impressive life sciences build-out, and China’s industry, once dismissed as a copycat, has become an innovator and disruptor too. Indeed, collaborations with the mainland have been a consequential part of Taiwan’s own biotech build-out. In 2016, for example, TaiGen Biotech was approved by the PRC Food and Drug Administration to sell its anti-pneumonia antibiotic, Taigexyn, on the mainland—a drug that underwent Phase 3 trials on both sides of the Taiwan Strait, including among a mainland Chinese clinical trial population.27

Taiwan firms have also relied on partnership arrangements with mainland biotechs, such as a marketing arrangement between TaiGen and Zhejiang Medicine, a joint-stock pharma firm established in May 1997 and listed on the Shanghai Stock Exchange.

Beyond marketing arrangements, the two sides collaborate to use clinical trial data for regulatory approvals. Since 2016, for example, select hospitals in Beijing and Shanghai have been able to provide clinical data for drug approvals by Taiwan’s regulator, and several Taiwan hospitals have been able to do the same with the regulator in Beijing. Mutual acceptance of clinical trial data has enabled the export of better practices from Taiwan, raising standards among mainland Chinese researchers, biotech companies, and healthcare providers.28

But the PRC has sometimes proved a tough nut to crack for Taiwan’s biotechs, not least because of customs barriers, an array of across- and behind-the-border investment restrictions, and regulatory hang-ups. These issues have, in the past, been a subject of discussion in now-moribund cross-strait economic talks.29

China’s biotech build-out has six factors in its favor:

First, there is the sheer scale that comes from having a population of 1.4 billion—an unchangeable reality that almost no other large market except India can match. This makes China a rich market for drugs and therapies but also an important test bed for clinical trials and experimentation. With cancer alone, for example, China “accounted for 24 percent of newly diagnosed cases and 30 percent of the cancer-related deaths worldwide in 2020.”30 China is also an aging society with a large segment of senior citizens who need drugs and therapeutics for various treatments and care. Unsurprisingly, given its size, China is now the world’s second-largest pharmaceuticals market after the United States.

Second, China is flush with funding from domestic and global listings, as well as domestic and global venture capital (VC) funds dedicated to biotech and life sciences–related industries. One survey notes that “the cumulative market value of China originating biotechs, listed on HKEX, STAR or NASDAQ, rose from US$1 billion in 2016 to US$180 billion as of May 2021” (see figure 4).31

Third, the Chinese state has enthusiastically supported the sector, with a domestic spend from the central and local governments that one study conservatively estimates at $100 billion, as well as a national architecture of life sciences parks and investment zones buttressed by Beijing-backed tax incentives and subsidies.32

Fourth, China has been spectacularly successful with the contract research outsourcing and contract development and manufacturing outsourcing (CRO/CDMO) models that emerged in recent decades as the most common strategy for the global pharmaceutical industry to reduce costs and maximize scalability.33 With lower costs, an educated workforce, and aggressive investment from Beijing, China became an attractive CRO destination that then evolved beyond this outsourcing-based model to indigenous drug discovery and R&D.

Fifth, Beijing has encouraged a talent pipeline that is now fueling this indigenous Chinese innovation, including company founders who began their journeys as CRO entrepreneurs. Ironically, this development in mainland China both draws from and mirrors the lessons of Taiwan’s own decades-long legacy of “brain circulation.” One 2018 estimate suggested that some 250,000 of the 2 million returnees to mainland China between 2012 and 2018 landed in jobs in the life sciences.34

Sixth, Beijing has leveraged its weight in the global system to attract multinational partners and investment to China. But that is not all: more ominously, Beijing has also used its strategic and geopolitical weight to deter these same players from collaborating with Taiwan.

Here’s how: Chinese pharma players hold the marketing rights to many new drugs, including from leading American and European multinationals. And they hold the marketing rights, too, to some emerging drugs from global start-up companies. Increasingly, including in the much-publicized case of Pfizer’s mRNA coronavirus vaccine, Comirnaty, Beijing leverages this control of marketing and distribution rights to isolate Taiwan and then restrict its access to drugs and medicines. In the Pfizer case, Beijing denied that it was doing this, but many have suggested that it views restricting access to drugs through control of distribution and marketing rights as a tempting tactic for bringing coercive pressure to bear on Taipei on cross-strait political issues.35

For its part, Taipei has restricted access to Taiwan for drugs that are marketed by mainland Chinese pharmaceutical firms.36 So, Beijing’s pressure in linking access to medicines to political issues has become a sensitive, even explosive, issue in Taiwan’s politics. As a result, it is becoming harder for the government in Taiwan to clear drugs for import that originate with Chinese pharma players or where these players hold the marketing rights even to medicines that originate with multinational firms.

But despite these six advantages, China has one significant and growing disadvantage—one that could unlock new supply chain and investment opportunities for neighboring Taiwan: Bluntly put, China isn’t trusted, while trust is Taiwan’s most valuable currency. This includes trust in Taiwan’s good governance, trust in the transparency that comes from being a well-functioning democracy, trust in well-considered regulation and administrative procedures, and trust in Taiwan’s transparent collection, use, and management of high-quality public sector data.

Convergence of Trust and Geopolitics

China offers a huge market and unprecedented scale but without the distinctive advantages of inherent trust. And that sense of mistrust is growing. Indeed, distrust in China-origin products, not to mention the heavy hand of the state in Beijing’s ambitious biotech build-out, is leading to political pressure worldwide to “China proof” elements of supply chains and business models.

In the United States, especially, this debate has grown across industries. And it has bled into the biomedical industry too, as politicians and regulators increasingly scrutinize American vulnerabilities and dependence on China-origin supply chains, extending even to concern about run-of-the-mill biomedical products and active pharmaceutical ingredients.

During the pandemic, those supply chains have become a pregnant political issue that, ironically, has united strange political bedfellows, from the conservative right to the progressive left, who agree on little else.

One apparent goal is to reduce overreliance on Chinese supply, as expressed in a bipartisan December 2019 letter of concern from unlikely allies Senators Elizabeth Warren (D-Mass) and Tom Cotton (R-Ark) warning of “overreliance on Chinese API exports” and calling for “strategies to avoid over- or sole-reliance on China for its critical drugs and drug ingredients.”37

A more confrontational effort, solely from the Republican side of the aisle, aims to legislate products originating in the PRC out of the American supply chain entirely, calling them “a national security threat” and seeking, by law, to “prohibit pharmaceutical purchases from China or products created with active pharmaceutical ingredients created in China.”38

The bill, S. 3537,39 is unlikely to become law, but it suggests the degree to which trust and supply chains are increasingly linked in American political discourse and multinational discussions. So, Taiwan’s opportunity is to leverage trust to compensate for its lack of scale—precisely the opposite of the PRC’s quite attractive offering to multinational investors and partners.

A 2020 Carnegie Endowment study of Taiwan’s innovation ecosystem recommended that it strive to leverage trust in multiple ways—as a trusted hub, trusted vendor, trusted tester, and trusted conduit to third-party markets.40 Each of these could confer advantages in Taiwan’s biotech and life sciences build-out, where the link between data and trust could be particularly important for IP protection and clinical trials.

Logically, the bigger the market, the larger the available data sets—and this scale advantage works in China’s favor because more access to more data gives a firm anchored in a larger marketplace a comparative advantage. But in some areas, data quality matters as much as quantity. And since Taiwan is a leader in data protection and privacy standards, its high-quality public sector healthcare data sets could be leveraged to attract multinational players.

Data Plays

For example, Taiwan could distinguish itself not just from China but from other countries if it could ensure easy access to some high quality nonsensitive public sector data sets.41 And if Taiwan could secure its design data—and the data of its partners—while also securing its IP from poaching and theft, it could become a larger partner in multinational strategies to successfully shape the future market.

But this will not be easy. Taiwan is certainly not the first to have thought about leveraging healthcare data as a driver for innovation and revenue. Brazil has done the same, and Japan has pursued this line of effort for years. So, Taiwan will need not just to achieve data integration but also to facilitate cross-border data access and transfers. Data flow is one of the largest challenges facing the biopharma industry because there has yet to be a global standard for good data governance that doesn’t confound national security with privacy and secure management.

So, Taiwan should strive to provide a solution, not least by finding a way to integrate and then market to global firms access to its data sets.

Currently, Taiwan’s single-payer, compulsory National Health Insurance scheme (NHI42) is pursuing an ambitious big data platform project that aims to integrate all public sector data sets,43 including the NHI database, the Taiwan Biobank database,44 and other databases collected by different parts of Taiwan’s public sector. But these data sets cannot be easily integrated because they have different structures and different policies were used to collect each data set.

The NHI data set, for example, encompasses almost 100 percent of medical records in Taiwan—the records of nearly 24 million people—but this promising data set cannot be used by industry because, when it was first established, patients were not given the option to approve data transfers. Now, as Taiwan contemplates leveraging the NHI data set as a potential competitive advantage with global pharmaceuticals, it cannot do so without regulatory reforms to solve this legacy problem. Building support for such reforms will be easier if Taiwan can promote better software development practices and reduce the risk of cyber attacks that lead to the theft of sensitive personal data or confidential corporate data (as described in the section on software supply chains).

A Strategy of Partnerships

Ideally, all this should be reflected in a broadened approach to strategy and policy—one that achieves two key goals.

First, Taiwan’s strategy should aim not just to target biotech as a sector, as in its current strategic plans, but to reflect the way in which biotech is becoming a span of capability across industrial verticals.

Second, and most important, Taiwan needs not just more domestic capability but vastly expanded international partnerships.

Taipei’s current ambitions are reflected, above all, in two aspirational government plans and a package of laws and regulations: the 5+2 Innovative Industries Plan announced in 2016, the Six Core Industries Plan launched in 2020, and the Biotech and New Pharmaceutical Development Act of 2007. The latter offered incentives to companies, permitted publicly funded researchers to conduct private sector R&D, allowed government scientists to serve as corporate executives or consultants, and enshrined an initial package of tax incentives and offsets.45

A 2020 draft revision broadened this law into the Biotech and Medicine Industry Development Act, offering additional tax incentives.46 President Tsai Ing-wen’s administration aims to extend the act for another decade while expanding its focus to include not only drug discovery but also a fresh emphasis on AI and digital medicine including through an enhanced role for the DCB.47

Internationalization is the crucial variable because the partnership model is so important to the biopharmaceutical industry.

The industry is capital intensive and high-risk. And as multinational players contemplate their build-out in Asia, they constantly evaluate competition, environmental influences, and global and regional headwinds. But Taiwan is squeezed in this evaluation because two of its neighbors are widely seen as the two key growth markets: Japan for innovative biopharma, and China for drugs overall.

As a first step, then, Taiwan needs policy reforms to adequately reward innovation. This includes rejiggering policies around investment, pricing, and especially reimbursement, but, ultimately, it means incentivizing international collaborations as the key target for Taiwan’s biotech companies.

Given the small size of Taiwan’s domestic market, this could include being a trusted conduit to develop drugs for markets elsewhere. After all, there will be a strong technology strategy element to determining success with future drugs and therapies, but tailoring those strategies to emergent markets will be the crucial long-term play.

And Taiwan has long-standing connections to some key Southeast Asian emerging markets, such as Indonesia, where Taichung-based vaccine-maker Adimmune conducted clinical trials for its coronavirus vaccine candidate, AdimrSC-2f. The company claims that its vaccine is halal, a fact that could, for example, open up new market opportunities for the vaccine and other medicines in the Islamic world.48

Beyond drugs, Taiwan-owned hospitals operate across Southeast Asia—in Thailand, for instance—creating opportunities to jointly market drugs and therapies from multinationals in Taiwan-owned and operated regional hubs. Taiwan’s Ministry of Health operates a Medical New Southbound Policy with six priority countries in South and Southeast Asia: India, Indonesia, the Philippines, Malaysia, Thailand, and Vietnam. The program primarily promotes training and information exchange; but it also promotes regulatory changes and conducts market surveys that could offer new opportunities for multinational partners to jointly cultivate these emerging markets as part of an expanded role as a trusted conduit.49

But beyond the developing and marketing of products, there is another way to think about the biotech supply chain—namely, as a platform for providing life sciences–related services. Providing quality of care, such as through biotherapeutics, is no longer viewed in the industry merely as providing a pill that is premade and prescribed by a doctor. With the launching of big data, as well as precision medicine, cell gene therapy, and a growing emphasis on early onset diagnostic and prevention as a way of holding down the costs of public health, companies are considering product launches in new ways.

This, too, is a biomedical supply chain opportunity for Taiwan, as more global firms weigh how to foster end-to-end care, from diagnostics to prevention to identifying patients to their ultimate cure.

So, instead of merely being a goods market, some multinationals now consider biopharma a service industry. And Taiwan has unique advantages, not least as a potential hub for medical tourism, as precision medicine integrates data, diagnostics, and treatment to enhance quality-of-life.

Enhanced U.S.-Taiwan Collaborations

These supply chain opportunities offer an opening to the United States and Taiwan to enhance their already robust cooperation. As a near-term priority, Washington and Taipei should take several steps:

- Negotiate an enhanced and more comprehensive science and technology agreement covering applied research, as well as technology development and demonstration, in addition to the existing emphasis on basic research.50

- Convene a standing biotech working group under this enhanced agreement.

- Charge the Office of the U.S. Trade Representative and Taiwan counterparts to launch negotiations toward an agreement on pharmaceuticals and medical devices drawn from the annexes in the Trans-Pacific Partnership;51 this agreement could subsequently be rolled into a prospective bilateral trade agreement once the two sides launch negotiations.52

- Use future meetings of the bilateral Trade and Investment Framework Agreement to coordinate on enhanced biotech and medical supply chains.

- Pursue an agreement on digital trade that addresses the cross-border barriers to data flow that hinder Taiwan’s ability to leverage its data advantages in the life sciences.

- Stand up a joint U.S.-Taiwan Standards Working Group, drawn from the private sector and regulatory bodies, to explore coordination in international standard-setting bodies. Although Taiwan’s international space is constricted by political pressure from Beijing, in the world of standard-setting, nonstate actors—such as firms and research laboratories—are often more effective and enduring because governments do not have the loudest voices in many of the private sector–led groups.53

- Take steps to enhance Taiwan’s coordination with the U.S. National Institutes of Health and U.S. regulatory bodies around the architecture of biotech research—for instance, increasing Taiwan firms’ access to transgenic mice to enable collaboration and enhanced research opportunities for Taiwan-based firms.

- Launch a U.S.-Taiwan “Health Security and Data” dialogue, led by the U.S. Department of Health and Human Services and the Taiwan Ministry of Health. This dialogue should aim not just at coordination in biopharma but at the data requisites of precision medicine and digital healthcare.

- Jointly spearhead efforts within the Asia-Pacific Economic Cooperation (APEC) forum to agree on enhanced cross-border data rules as applied to medical data. Taiwan has already joined the APEC Cross-Border Privacy Rules system for privacy and data transfer; Taipei and Washington could convene an ad hoc working group of APEC first-movers to discuss data governance as applied to biopharma and digital healthcare.

- Establish new U.S.-Taiwan university partnerships to drive partnership opportunities for the trusted infrastructure needed for AI applications in biotechnology. The incubator model that Taiwan’s government and industry have emphasized is not sufficient. Enduring partnerships in the science, technology, engineering, and mathematics (STEM) fields linking Taiwan and the United States should aim to bake in security from the start of design, including in universities, in such areas as big data, machine learning, neural networks, and the Internet of Things.

- Ramp up educational exchanges to help foster a next-generation biotech talent pipeline for Taiwan by establishing a sector-specific U.S.-Taiwan educational advisory panel. Two decades of brain drain have taken a toll on the size and diversity of the overall STEM workforce.54

- Build on Carnegie’s 2020 recommendation to establish a transpacific advisory panel encompassing domestic technology leaders in Taiwan, representatives of U.S. firms doing R&D in Taiwan, the VC industries on both sides of the Pacific, and university leaders. Specifically, establish a biotechnology and digital healthcare working group under this proposed panel to better address gaps in Taiwan’s domestic skills base and then connect efforts to redress those gaps to anticipated focus areas for investment.55

- Support industry-led mentorships for engineers developing biotechnology applications within Taiwan’s semiconductor and AI firms. Scale these mentoring programs through public-private partnerships.

- Taiwan should ease work visa and market entry policies to encourage global start-ups, as well as big pharma firms, to establish beachheads in Taiwan.

Seizing Supply Chain Opportunities for Safer Software

As the world struggles to emerge from the coronavirus pandemic, there has been growing concern—and, in some cases, panic—about supply chain disruptions in many sectors. News stories have focused on disruptions to low-tech industries,56 such as the personal protective equipment needed to mitigate the effects of the pandemic,57 but also high-tech industries, such as semiconductor chip manufacturing,58 an industry that is at the very core of Taiwan’s economy and comparative advantage.

But the problem of supply chain risks is more pervasive. While most of the focus has been on physical goods, there are growing vulnerabilities in software supply chains, too.

Malicious hackers, hostile states, and insiders have many techniques for inserting malware into code that can then be spread unknowingly by software providers. For instance, attackers can corrupt the code in software patches needed to update and improve software that is already installed.59 In other cases, they can insert malware into or exploit vulnerabilities in software components in the software libraries or programming tools that many developers rely upon to assemble complicated IT systems.

The SolarWinds hack,60 the Kaseya ransomware attack,61 and other similar attacks on the software supply chain in which thousands of different companies were affected by a single attack on a single, widely used service, alerted policymakers, the media, and the public to the growing need to protect and improve the software supply chain and software development practices. And this is true of both the public sector and the private sector.

So, now is an opportune time for Taiwan to explore whether it can play an enhanced role in increasing trust in software producers and developers.

As governments and the private sector grapple with software vulnerabilities, Taiwan has the potential to become a global leader, especially in software development for IoT applications. The analysis below explores the challenges facing software supply chains, the existing market strengths of Taiwan, and the steps it could take to become a leader in software development. Taiwan has the potential to become a model for others.

Most government cybersecurity programs and a large majority of the reporting about cybersecurity focus on two topics: (1) what businesses and individuals can do to avoid being a victim of a cyber attack or cyber crime, and (2) what governments can do to identify and track down the responsible malicious hackers. Unfortunately, too little attention is being given to what governments can do to foster safer software development practices. Better, more secure software with fewer vulnerabilities that cyber criminals and hostile governments can exploit could dramatically reduce the threats and costs from cyber attacks.

The Need for Safer Software

The American software developer and venture capitalist Marc Andreessen is known for developing Mosaic, the first graphical Web browser, and for saying in 2011 that “software is eating the world.”62 Andreessen added that it had become clear that nearly all of the global economy (not just the high-tech sector) is critically dependent on software.

But much of that software—especially outside the technology sector—is unreliable and full of vulnerabilities. And this problem has become worse because of the availability of easy-to-use software tools, easy-to-repurpose software components, and online cloud services that make it much easier to assemble software. Coding is being democratized.63 From an industry standpoint, that is a good thing—but it means that a great deal more software is being developed by people without the necessary training and experience to make, deploy, and run it in a secure and safe way.

And today, software and systems are often being updated almost continuously. Indeed, sometimes, updates need to happen every day or two. Twenty years ago, a program like Microsoft Windows had a three-year upgrade cycle—offering plenty of time for thorough security reviews. Today, by contrast, too many companies are releasing alpha code and fixing problems after thousands of people are already using (and relying upon) their systems.

A successful start-up can release a popular new product that might be downloaded millions of times in a month or two. With the IoT, inexpensive, networked devices have ended up everywhere. If vulnerabilities in the software are then exploited by malicious hackers, they not only can affect millions of people worldwide but their attacks could also disrupt the internet itself. For example, in 2016, the distributed denial of service attack on Dyn,64 which affected dozens of the most popular websites, including Twitter, Netflix, BBC, and CNN, was caused mostly by insecure software on more than 100,000 networked devices.

More than ever, at software companies, there is a premium on speed when it comes to developing software. Start-ups, in particular, are under intense pressure to bring their product or service to market. Investors want revenue. Developers want their ideas and products to be tested in the marketplace. So, there just are not enough incentives in many cases to ensure that companies do not cut corners on testing and securing their software.

Taiwan’s Software Challenge

Taiwan’s hardware advantages are at the very core of its economy, and it is perhaps the world leader in semiconductor chip manufacturing. According to a 2020 report from Boston Consulting Group and the Software Industry Association, Taiwan accounts for more than 20 percent of global chip manufacturing capability—more than mainland China and far more than the United States.65 The information and communications technology industry accounted for 17 percent of Taiwan’s gross domestic product and 34 percent of all investment in 2019,66 and most of this comes from hardware manufacturing. Among economies with the most developed semiconductor manufacturing sectors, Taiwan’s sector represents the largest share of domestic production (see figure 6) but lags far behind world leaders like the United States when it comes to software (see figure 7). If Taiwan is to diversify its innovation base by becoming as successful in software as it has been in hardware, it needs not just to invest blindly but to invest in unique advantages that can differentiate itself from other economies.

One effective way to do this would be to develop a global reputation for well-tested, highly secure software and systems. Taiwan-based companies could be a model for companies (and economies) around the world. But this will require leveraging Taiwan’s strengths in new ways—and policy adjustments aimed at fostering this capability.

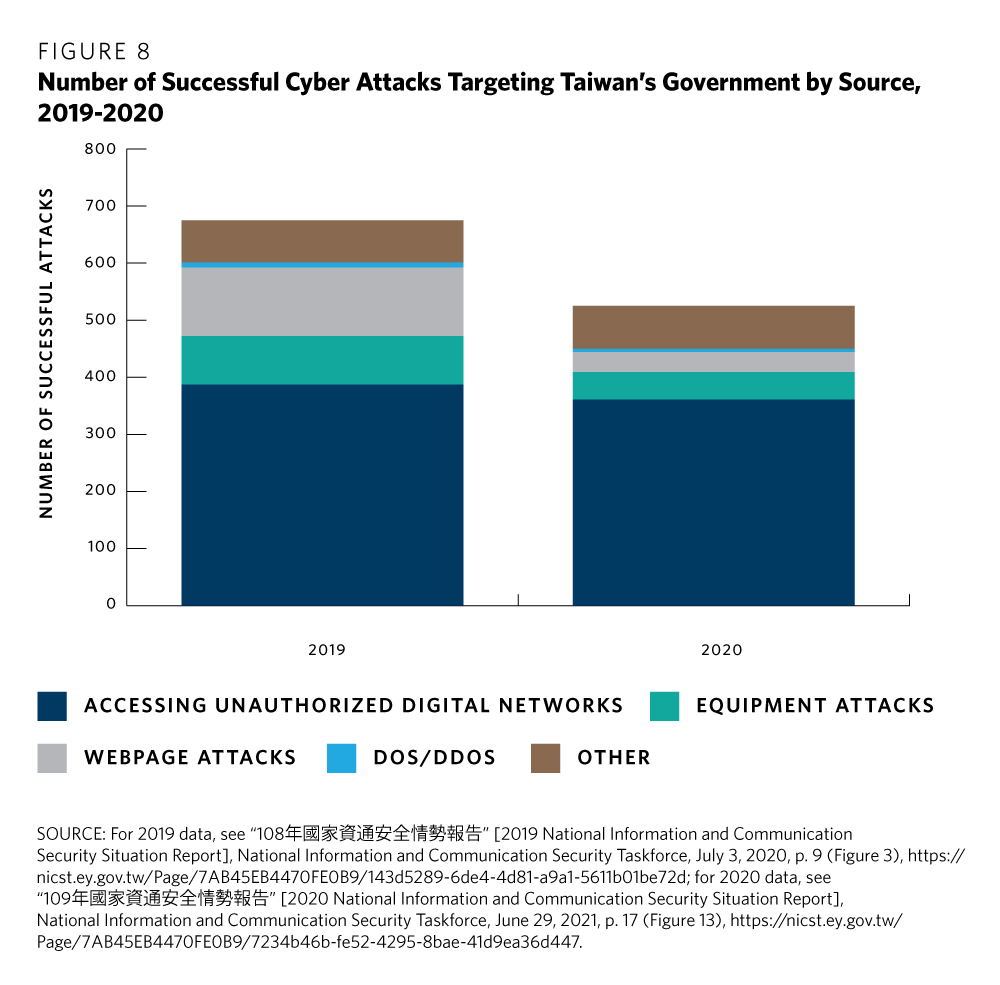

Taiwan has four obvious advantages in pursuing this goal. First, the government and Taiwan-based companies have had success in countering the persistent threat of cyber attacks from mainland China (as illustrated by figures 8 and 9). But more effort is required, which means that Taiwan-based companies inherently need secure IT software, services, and systems. Similarly, customers globally demand products and services that can demonstrate they provide best-in-class cybersecurity. In addition, growing distrust of technology originating in mainland China means that potential customers around the world might shy away from buying such devices or using China’s online services.

Taiwan’s second advantage is the cloud because it launched a major initiative to shift to the cloud as early as 2010,67 with an initial five-year public investment of $744 million, a bureaucratic reorganization, and incentives for private sector matching funds.68 Taiwan established a cabinet advisory task force for the cloud reporting to a minister without portfolio and ultimately to the premier,69 and an industry consortium followed suit with four public and private sector–led task forces in coordination with the Ministry of Economic Affairs—on cloud systems; cloud services; regulation and standards; and technology cooperation and promotion.70 This effort was led by the government-backed Industrial Technology Research Institute, which played a major role in Taiwan’s earlier-generation hardware build-out.71

In addition to writing better code, Taiwan-based companies have an opportunity, therefore, to build a reputation for being better at using cloud services in a careful, secure way. And this could be done in coordination with major global industry leaders. For example, the American chip giant Intel has worked with Taiwan’s National Science Council to promote cloud computing research in Taiwan.72

Companies and public agencies in Taiwan clearly understand the need to shift to the cloud—and to align with trends and practices elsewhere. Thus, the 2010 initiative began at about the same time that Barack Obama’s administration in the United States adopted a Cloud First strategy.

Relying on cloud computing enables organizations to take advantage of the world-class security practices at most of the global cloud service providers. But that requires picking the right cloud services and configuring them properly.73 And it means properly encrypting data sent to and from cloud providers. Each year, many companies discover that their sensitive data have leaked because one employee made a single, simple mistake when setting up a cloud-based service. Fortunately, leading service providers (for example, Amazon, Google, and Microsoft) have advisers and tools to help their customers spot such errors. And groups like the Cloud Security Alliance and the Global Cyber Alliance have developed guidelines for safely using cloud services and adopting multicloud strategies to ensure needed services are always on.74

Taiwan’s third advantage—one that makes it uniquely competitive in developing and marketing safer software—is its best-in-class hardware ecosystem. The fact is, Taiwan will make many of the chips and devices needed for the Internet of Things. So, global developers creating the software for IoT devices and their related data systems could benefit by linking to the companies, including in Taiwan, that will be building the hardware.

For their part, software start-ups could benefit from the partnerships between the hardware companies in Taiwan and leading IT companies elsewhere. This kind of synergy is possible in few other places. And so, Taiwan is well-positioned to be a leader in the development of the IoT—if it can invest to provide superior software for IoT devices and systems.

Taiwan’s fourth advantage involves the data needed for developing machine learning algorithms, one of the most promising and fastest-growing sectors of the software industry with compounded annual growth rates projected to exceed 40 percent over the next four years.75

But useful, reliable machine learning algorithms need to be trained using reliable, accurate, consistent, representative data. In this regard, Taiwan has a data advantage—the innovative uses of open data by Taiwan’s public sector76 (including data from the national health insurance system).77 The high-quality data collected by the government can enable powerful demonstration projects that could spur the growth of commercial products and services.

Next Steps for Taiwan’s Innovators

One reason software development has become faster and easier is the widespread use of developer platforms that automate many aspects of coding, including basic security testing. But developers need to actually take the time to use those built-in tools (and fix the problems they identify).

When building complex systems, companies should turn to other firms that provide automated tools for checking software and mobile devices, such as NowSecure and IonChannel. To understand how to protect against attacks, developers and software architects are learning to develop threat models before they start coding—allowing them to prepare for and thwart various types of cyber attacks. However, even with secure code, an app or a device will not protect customers and their data if they don’t have to follow proper security procedures when logging on or when downloading the data and analysis it generates.

Of course, cloud computing services tend to be more secure, more reliable, and better tested and hardened than custom-built IT systems—at least among the largest players, the so-called hyperscalers. Start-ups, which often have a hard time recruiting scarce cybersecurity experts, can benefit most from relying on cloud services, and not just for serving their customers but for supporting their own employees as well.

Another benefit of building systems in the cloud is that, by running their software on cloud data centers around the world, Taiwan-based companies could more easily scale and better serve customers outside of East Asia. And they could leverage the reputation and trust that cloud service providers have developed.

Taiwan’s potential niche opportunity stems from the fact that there is a clear need for a better way to determine whether software components and IT systems are secure and tested. Too often, malicious hackers are able to exploit common vulnerabilities that have been known for years—but have not been fixed. To do so will require more collaboration among developers and the organizations they work for.

There are already several initiatives to detect and correct vulnerabilities in some types of open-source software. GitHub, for example, has been a leader, providing tools to help developers assess the open-source software they might want to incorporate into their systems and products,78 but developers must be motivated to actually use these tools.

One promising development that Taiwan could take advantage of are proposals for trustmarks that indicate that software (especially commonly used software components) has been properly vetted and tested. Another concept, promoted strongly in the recent cybersecurity executive order from U.S. President Joe Biden, is the Software Bill of Materials,79 which provides an inventory of the different elements in software components, much like the ingredient label on packaged food. While this does not indicate if a component is free of vulnerabilities, it allows users to quickly determine if they have a problem that needs to be addressed whenever new vulnerabilities are found.

A parallel step that Taiwan-based IT companies can take to foster a culture of safer software is to be more transparent when a cyber attack or data breach occurs. In particular, identifying the software vulnerabilities exploited by attackers—and the companies that failed to fix them—could help motivate software developers in Taiwan and everywhere else. Too often, attacks are reported in the media but the companies providing the software are not.

Overcoming Barriers in Taiwan

Taiwan’s biggest challenge to becoming a major player in safer software is that proper security reviews and software testing take time as well as expertise. Both are in short supply everywhere, especially at fast-moving start-ups, and Taiwan is no exception to this global bottleneck.

A thorough security review costs money—and each code update requires significant work. Sometimes developers find it is simplest to incorporate open-source software components into their code and then hope that the community that maintains the open-source software has paid enough attention to security. But unfortunately, that is not always the case.

And Taiwan-based companies have a particular handicap: unlike software companies in the United States or Japan, most software designed in Taiwan is developed only for the local market, which itself is relatively small in scale. Limited sales mean limited revenues. And that means there is little money to invest in refining and securing the code.

Taiwan faces another unique challenge because many of the best computer science and electrical engineering students in Taiwan gravitate to the hardware sector, and to two companies in particular—Taiwan Semiconductor Manufacturing Company and MediaTek, which jointly soak up a disproportionate share of Taiwan’s engineering graduates annually. That is a net loss for Taiwan’s software potential because good or great software developers require lifelong learning; they cannot simply jump industries.

The fact that technology is moving so fast and new languages and powerful new tools are popping up every year is exciting but exhausting. For Taiwan’s software-based industries to provide exciting opportunities to build better, safer, world-class software and systems will necessitate motivating more students to join software companies (particularly start-ups), but this will require significantly more investment in Taiwan’s talent pipeline.

Getting Software Policies Right

Policymakers in Taiwan are working hard to spur the development and adoption of digital technologies, but many of them, like policymakers elsewhere, do not realize just how insecure some parts of the software supply chain are. Many people working in private sector–led IT companies and the chief information officers who buy their software can be fatalists: they simply accept that software will be buggy and that systems will be hacked. Few developers, innovators, managers, and end users publicize the problem out of concern for lost reputation, income, and customers.

Governments are different: they want security, not fatalism, to prevail. But too often, governments fail to publicize vulnerabilities and the successful measures taken to address them. Like others around the world, policymakers in Taiwan need to do so to help motivate renewed efforts to find and fix bugs in software supply chains.

Perhaps Taipei’s most important challenge, therefore, is to communicate clearly that it is making safer software development a policy priority. One way to do so is to make clear that government procurement will favor better security over lower prices. By using the power of government procurement in this way, Taipei can require software providers to have a well-defined, standards-based software testing program in place. Taiwan’s policymakers do not need to mandate just one approach; instead, different companies in different sectors will have different needs and face different levels of risk, which raises the bar for policy.

One place to start is to focus on security for IoT devices. Taiwan has big ambitions in this area, and 2019 was a banner year for the sector on the island. According to the National Development Council, output from Taiwan’s IoT sector reached $43.6 billion in 2019, up nearly 12 percent year-on-year and breaking prior records.80

Some IoT devices, which are often mass-market devices, run software that cannot be updated. Fortunately, several groups have developed guidelines that could help to secure IoT systems.81 So, Taiwan’s government has an opportunity to follow the lead of the United States—and enhance coordination across the Pacific through, for example, a U.S.-Taiwan IoT standards working group, pushed along perhaps at future sessions of the U.S.-Taiwan Trade and Investment Framework Agreement or under an enhanced next-iteration of the Science and Technology Agreement the two sides signed in December 2020. The U.S. Congress has approved legislation that requires that IoT systems purchased by the U.S. government comply with minimum security recommendations issued by the National Institute of Standards and Technology; Taiwan could certainly strive to meet these standards as a prospective supplier.82

Another important step policymakers in Taipei could take would be to encourage Taiwan-based companies to apply for voluntary, third-party trustmarks that affirm that they are developing software in accord with industry best practices for software design and testing.83 For example, the Computer Technology Industry Association, CompTIA, has developed trustmarks used by small IT firms around the world.84

Taiwan’s government could also help Taiwan-based firms (and especially start-ups) to improve the quality and security of their software and systems by subsidizing access to cybersecurity experts and automated software testing tools. In effect, Taiwan could do for its software sector what the U.S. government did for its small manufacturers by setting up the manufacturing extension program run by the U.S. National Institute of Standards and Technology, which for more than twenty-five years has helped American manufacturers, particularly small firms, improve the technology and techniques they use.

A more ambitious build-out would see Taipei go even further by funding programs that reward individual programmers who find bugs in open-source software components, and possibly for start-ups that need help finding and fixing vulnerabilities in their beta code. This would not only improve the quality of software from Taiwan-based companies but also position Taiwan as a critical player in the global open-source software community.

The insurance industry, too, is taking on a growing role in assessing the cybersecurity of firms. So, Taiwan’s government should weigh how it could work with the insurance sector to reward companies that rely on safer software. One way to do so would be through lower premiums. This could also be done by incentivizing security audits and/or by encouraging the use of trustmarks.